Page 53 - ESPC Magazine Jan 2021

P. 53

MORTGAGE ADVICE INTERIORS

WHAT’S GOING TO HAPPEN IN THE

MORTGAGE MARKET IN 2021?

David Lauder, Independent Mortgage Adviser with ESPC Mortgages, makes some

predictions for the 2021 mortgage and property market.

In the current pandemic We saw interest rates fall in 2020 as it helped boost the

and financial climate, to 0.1% in 2020, and some deposits of first time buyers,

making predictions for the forecast rates may fall again will reopen in 2021. This will

coming year is a difficult below zero in 2021 to allow likely encourage more first

task, particularly in light of the central bank to support time buyers to the market.

recent lockdown restrictions. the economy but much

However, this is some of will depend on how quickly Contact ESPC Mortgages on

the activity I expect in the and safely we can return to fsenquiries@espc.com or

mortgage and property relative normality. 0131 253 2920.

market in 2021.

Any interest rate increases

For most clients, it has are not likely to be

remained very much a imminent, but I expect any

seller’s market for much of future rises to be gradual

2020. This is due to a lack and incremental which

of stock being available and should give prospective

plenty of buyer demand buyers peace of mind for the

after lockdown. next two to three years.

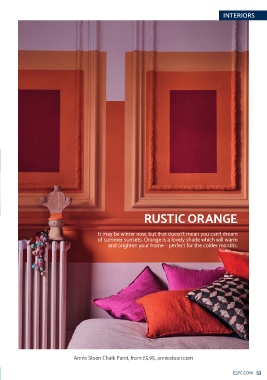

However, we are only very For much of 2020 the RUSTIC ORANGE

recently starting to see signs minimum level of deposit

The information contained in this article

of the market levelling off, generally required by is provided in good faith. Whilst every It may be winter now, but that doesn’t mean you can’t dream

with properties selling at or lenders was 15%. However, care has been taken in the preparation of summer sunsets. Orange is a lovely shade which will warm

of the information, no responsibility is

around the Home Report mortgage lenders are accepted for any errors which, despite and brighten your home – perfect for the colder months.

valuation and indications slowly showing a bit of our precautions, it may contain. No

currently point to that increased confidence. At individual mortgage advice is given, nor

continuing into early 2021. the end of 2020 there were intended to be given in this article.

at least four lenders willing The initial consultation with an

As 2021 progresses, it to consider a 10% deposit adviser is free and without obligation.

is likely people will see subject to eligibility and Thereafter, ESPC Mortgages charges

properties begin to move buying status. for mortgage advice are usually £350

(£295 for first time buyers). YOUR

quickly again, which will HOME MAY BE REPOSSESSED

increase seller confidence, Hopefully, this trend will IF YOU DO NOT KEEP UP

helping to bring more continue, and more lenders REPAYMENTS ON A MORTGAGE OR

OTHER LOANS SECURED AGAINST

properties to the market. will start to offer 10%

IT.

deposit mortgages.

Another helpful market ESPC (UK) Ltd is an Appointed

Representative of Lyncombe

condition is that interest For those struggling to save a Consultants Ltd which is authorised

rates are still very low. deposit, the First Home Fund and regulated by the Financial

scheme, which was popular Conduct Authority. Annie Sloan Chalk Paint, from £5.95, anniesloan.com

52 ESPC.COM ESPC.COM 53