Page 55 - July 2023

P. 55

EXPERT ADVICE ESPC PROPERTIES

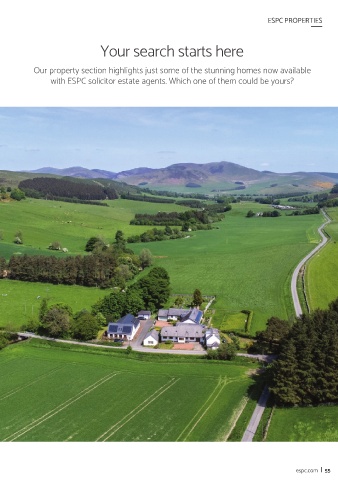

Top five mortgage tips for first-time buyers Your search starts here

Shirley Mushet, Independent Mortgage Adviser at ESPC Mortgages, gives Our property section highlights just some of the stunning homes now available

advice on how to approach a mortgage when buying your first property. with ESPC solicitor estate agents. Which one of them could be yours?

Read the tips below to help you make the

right choice for one of the biggest purchases

you will ever make.

1 Have your documents in order

Make sure your ID such as your

passport or driving licence is in date, as well

as the correct address on your driving licence

and on your supporting documents such as

bank statements.

2 Build your credit rating

When applying for a mortgage or any

credit, lenders will take in to account your

credit score.

3 Consider a Lifetime ISA to help

with your deposit

A Lifetime ISA can offer a 25% tax-free 4 Get in touch with an ESPC

government boost on savings. If you save

the maximum amount into the ISA each year mortgage consultant early

(£4,000), the government can boost your We can help you understand your affordability,

savings by £1,000 but check that you will be the process that you will be going through and

eligible for the scheme’s other criteria such hold your hand for the journey.

as maximum purchase price.

The savings and bonus amount can then 5 Do your research

be used for your deposit for a home. If you It is worth viewing a range of properties

decide not to use it for that, then you can also to understand what you can get for your

use it for retirement. money.

The initial consultation with an ESPC Mortgages adviser is free and The Financial Ombudsman Service is available to sort out

without obligation. Thereafter, ESPC Mortgages charges for mortgage individual complaints that clients and financial services businesses

advice are usually £395 (£345 for first-time buyers). YOUR HOME aren’t able to resolve themselves. To contact the Financial

MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS Ombudsman Service, please visit www.financial-ombudsman.org.uk.

ON A MORTGAGE OR OTHER LOANS SECURED AGAINST IT.

ESPC (UK) Ltd is an Appointed Representative of Lyncombe Consultants

The information contained within this website is subject to the UK Ltd which is authorised and regulated by the Financial Conduct Authority.

regulatory regime and therefore restricted to consumers based in the UK.

54 | espc.com espc.com | 55