Page 46 - ESPC Magazine - July 2021

P. 46

ESPC AREAS MORTGAGE ADVICE

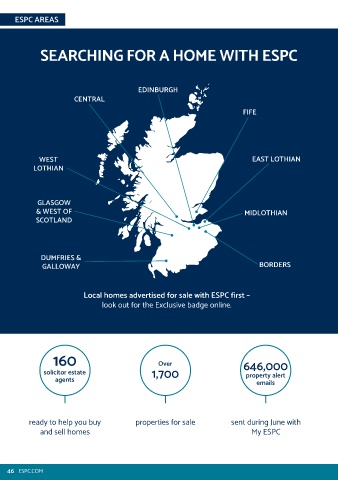

SEARCHING FOR A HOME WITH ESPC HOW THE UK MORTGAGE MARKET HAS

CHANGED DUE TO CORONAVIRUS

David Lauder, Independent Mortgage Adviser at ESPC Mortgages, looks at how the

EDINBURGH UK mortgage market has changed due to COVID-19.

CENTRAL

The mortgage world is different compared Another key change is that many lenders

FIFE to before COVID-19, with greater restrictions are asking if clients have been affected by

on lending and stricter assessment of furlough. Lenders will generally only use

documents and criteria in general. your full income if you have returned to

work or can evidence a return to work in the

One of the biggest changes to mortgages near future.

WEST EAST LOTHIAN as a result of the COVID-19 pandemic, is

LOTHIAN that for much of 2020 mortgage lenders Self-employed people are also being

raised minimum deposit levels to 15%, assessed more rigorously with questions

compared to 5% before COVID-19 (this being asked about how their business has

is based on the purchase price or Home been affected during COVID-19 and business

GLASGOW Report valuation of the property, whichever bank statements being regularly asked for

& WEST OF MIDLOTHIAN is the lower figure). to check how the business has performed

SCOTLAND during this time.

However, a greater number of lenders

started to offer 10% deposit mortgages at We are finding that mortgage applications

the start of 2021. The UK Government also are generally taking longer to be assessed

DUMFRIES & introduced the mortgage guarantee scheme due to current service levels and the high

GALLOWAY BORDERS to help bring 5% deposit mortgages back to volume being submitted. The normal two to

the market. three week turnaround for straightforward

cases to be approved may now take four to

Local homes advertised for sale with ESPC first – five weeks.

look out for the Exclusive badge online.

For independent mortgage advice, contact

the expert team at ESPC Mortgages on 0131

253 2920 or fsenquiries@espc.com

The information contained in this article is provided in good

160 Over 646,000 faith. Whilst every care has been taken in the preparation of

the information, no responsibility is accepted for any errors

solicitor estate 1,700 property alert which, despite our precautions, it may contain.

agents

emails

The initial consultation with an adviser is free and without

obligation. Thereafter, ESPC Mortgages charges for

mortgage advice are usually £350 (£295 for first-time

buyers). YOUR HOME MAY BE REPOSSESSED IF YOU

DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR

ready to help you buy properties for sale sent during June with OTHER LOANS SECURED AGAINST IT.

and sell homes My ESPC ESPC (UK) Ltd is an Appointed Representative of Lyncombe

Consultants Ltd which is authorised and regulated by the

Financial Conduct Authority.

46 ESPC.COM ESPC.COM 47