Page 27 - ESPC Training Booklet

P. 27

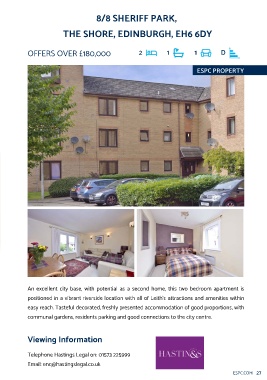

MORTGAGE ADVICE 8/8 SHERIFF PARK,

HOW THE MORTGAGE MARKET THE SHORE, EDINBURGH, EH6 6DY

HAS CHANGED

OFFERS OVER £180,000 2 1 1 D

David Lauder, Independent Mortgage Adviser at ESPC Mortgages, looks at how the

mortgage market has changed due to COVID-19. ESPC PROPERTY

The mortgage world is different compared to to current service levels and the high volume

before COVID-19, with greater restrictions on being submitted. The normal two to three

lending and stricter assessment of documents week turnaround for straightforward cases to

and criteria in general. The biggest change is be approved may now take four to five weeks.

that the typical minimum deposit requirement

for a mortgage is 15% now, compared to For independent mortgage advice, contact

5% before COVID-19 (this is based on the the expert team at ESPC Mortgages on

purchase price or Home Report valuation of 0131 253 2920, fsenquiries@espc.com or visit

the property, whichever is the lower figure). espc.com/mortgages

10% deposit mortgages are available with

a limited number of lenders, but they

generally come with strict lending criteria

and restrictions. Therefore, a 15% deposit

appears to be the new normal requirement.

For many first time buyers, saving a 15%

deposit can be challenging but there are

schemes available to help you boost your

deposit. A popular option is the First Home

Fund, which offers equity loans of up to

£25,000 to boost your deposit.

Another key change is that many lenders

are asking if clients have been affected by

furlough. Lenders will generally only use your

The information contained in this article is provided in good

full income if you have returned to work or can faith. Whilst every care has been taken in the preparation of

evidence a return to work in the near future. the information, no responsibility is accepted for any errors

which, despite our precautions, it may contain. No individual

mortgage advice is given, nor intended to be given in this

Self-employed people are also being article. An excellent city base, with potential as a second home, this two bedroom apartment is

assessed more rigorously with questions positioned in a vibrant riverside location with all of Leith's attractions and amenities within

being asked about how their business has The initial consultation with an ESPC Mortgages adviser is

free and without obligation. Thereafter, ESPC Mortgages easy reach. Tasteful decorated, freshly presented accommodation of good proportions, with

been affected during COVID-19. Business charges for mortgage advice are usually £350 (£295 for

bank statements are regularly asked for to first-time buyers). YOUR HOME MAY BE REPOSSESSED IF communal gardens, residents parking and good connections to the city centre.

check how the business has performed during YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE

this time. OR OTHER LOANS SECURED AGAINST IT.

Viewing Information

ESPC (UK) Ltd is an Appointed Representative of Lyncombe

We are finding that mortgage applications are Consultants Ltd which is authorised and regulated by the

generally taking longer to be assessed due Financial Conduct Authority. Telephone Hastings Legal on: 01573 225999

Email: enq@hastingslegal.co.uk

26 ESPC.COM ESPC.COM 27