Page 34 - May 2023

P. 34

INTERIORS INSIDER EXPERT ADVICE

How do offset mortgages work?

Aye aye captain! David Lauder, Independent Mortgage Adviser at ESPC Mortgages,

gives an overview of offset mortgages.

here are many different mortgage

products to choose from and one of the still have the option to pay in lump sums if you

prefer to the mortgage balance, however, the

Tmost powerful options to save money is offset savings account is doing the same thing,

offset mortgages as it means your money will as the total balance is aggregated against the

be working harder for you. mortgage debt.

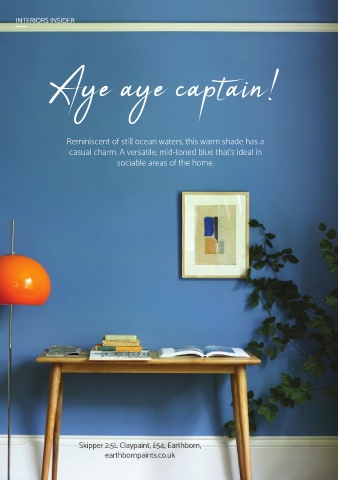

Reminiscent of still ocean waters, this warm shade has a

casual charm. A versatile, mid-toned blue that’s ideal in How does it work? Who can set up an offset

sociable areas of the home. Your outstanding mortgage mortgage?

balance is offset by your You may need to be at

savings balance which is a certain stage of your

required to be with your financial life to be suitable

mortgage provider in a but professionals, high net

separate account arranged worth clients or people who

by your lender, and you only are disciplined with their

pay interest on the surplus money and have a good

balance of the mortgage month to month surplus

instead of the full amount. which continues to build up

could certainly find this a

For instance, if your mortgage suitable solution.

is £100,000 and you have

£50,000 of savings then you It is worth noting that your

will only be charged interest savings in the offset facility

on the £50,000 surplus will accrue no interest

balance of your mortgage. but are, in essence, tax free

However, if you continue to which is an added bonus. In

make the required payments the current climate, an offset

based on the full £100,000 mortgage can be a good

balance then your mortgage option when mortgage rates

will be repaid even quicker. In are higher and means your

essence these will be treated as overpayments, money is working harder to reduce the level

and the interest payable will be considerably of interest accrued against these increased

less during the mortgage term. You will also rates.

ESPC Mortgages offer expert mortgage advice in Edinburgh. consultation with an adviser is free and without obligation.

If you are looking for mortgage advice, get in touch with the Thereafter, ESPC Mortgages’ charges for mortgage advice are

team on 0131 253 2920 or fsenquiries@espc.com usually £350 (£295 for first time buyers).

The information contained in this article is provided in good YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP

faith. Whilst every care has been taken in the preparation of UP REPAYMENTS ON A MORTGAGE OR OTHER LOANS

Skipper 2.5L Claypaint, £54, Earthborn,

the information, no responsibility is accepted for any errors SECURED AGAINST IT.

earthbornpaints.co.uk which, despite our precautions, it may contain. The initial

34 | espc.com espc.com | 35