Page 17 - Property market report-Mar-Aug24

P. 17

St Andrews offered the highest volume of properties selling time of 31 days during March-August 2024,

East Fife coming to the market, with volumes up 44.9% on which is three days slower year-on-year. This means

that East Fife homes were the second slowest to sell

the same time last year, followed by Kirkcaldy, Cupar,

Anstruther and Crail. across all ESPC regions after Dumfries & Galloway.

91.7% of properties for sale were marketed at ‘offers 17.1% of properties for sale in East Fife went to a

over’, suggesting that even despite higher levels of closing date, down from 20% in 2023 and 26.7% in

competition, sellers felt exceptionally confident in the March-August 2022, showing how much the rise in

market and in their property’s perceived value with availability impacts the competitive environment

buyers. This is very consistent with the levels seen in buyers and sellers may at this point be used to

recent years. experiencing.

Sales volumes also experienced an annual increase,

by a smaller 3.4%. Sought-after St Andrews had the

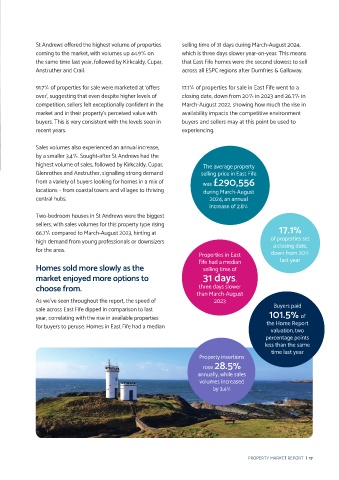

highest volume of sales, followed by Kirkcaldy, Cupar, The average property

Glenrothes and Anstruther, signalling strong demand selling price in East Fife

from a variety of buyers looking for homes in a mix of was £290,556

Average selling prices in East Fife secure a home for much closer to the Home Report locations – from coastal towns and villages to thriving during March-August

rose year-on-year. valuation figure. central hubs. 2024, an annual

increase of 2.8%

The average property selling price in East Fife during Buyers paid the highest premium for homes in Two-bedroom houses in St Andrews were the biggest

March-August 2024 was £290,556, an increase of Kirkcaldy; here, properties attained 103% of their sellers, with sales volumes for this property type rising

2.8% year-on-year. This makes East Fife the second- Home Report valuation on average, which is five 66.7% compared to March-August 2023, hinting at 17.1%

most expensive region covered by ESPC in which to percentage points higher than in March-August 2023, high demand from young professionals or downsizers of properties set

purchase a property, and the most expensive outside indicating that there is significant demand for homes for the area. a closing date,

of Edinburgh. in this part of East Fife. Properties in East down from 20%

last year

Fife had a median

Homes sold more slowly as the selling time of

There was high contrast in average selling prices 66.3% of properties sold for at least their Home market enjoyed more options to

31 days,

across this broad and varied region; the highly Report valuation, down from 71.8% in March-August three days slower

sought-after St Andrews was the most expensive 2023. This suggests good news for buyers, who can choose from. than March-August

area of East Fife to buy a property, with average reasonably expect to secure a home for much closer As we’ve seen throughout the report, the speed of 2023

selling prices in the area reaching £382,381. By to its valuation figure. It also suggests that sellers may sale across East Fife dipped in comparison to last Buyers paid

contrast, Kirkcaldy was the most affordable area, be more open to selling for a lesser premium than in year, correlating with the rise in available properties 101.5% of

with homes in this part of the region selling for an years past, in order to secure a quicker sale and move for buyers to peruse. Homes in East Fife had a median the Home Report

valuation, two

average of £219,991. onto their own onward purchase. percentage points

less than the same

Buyers paid closer to the valuation New property listings soared across Property insertions time last year

price as competition dramatically the East Fife property market. rose 28.5%

reduced.

Buyers in East Fife enjoyed a bumper crop of listings annually, while sales

volumes increased

Properties for sale in East Fife achieved 101.5% of coming onto the local market in March-August,

by 3.4%

their Home Report valuation on average, which is with volumes of new properties becoming available

two percentage points down on March-August 2023. rocketing 28.5% year-on-year. This significant increase

This is a pattern we will see repeated throughout this could be the reason for Home Report premiums

report; with higher volumes of properties coming dipping, with buyers enjoying a reduced onus on them

onto the market, buyers can enjoy much-reduced to bid significantly over value, as there are many more

pressure and competition, thus allowing them to homes available to satisfy buyer demand.

16 | PROPERTY MARKET REPORT PROPERTY MARKET REPORT | 17